Tips & tricks from financial education

Financial responsibility can be taught from an early age, and introducing money concepts and providing financial education to children is a great way to ensure that we raise adults who are well-balanced, adaptable and ready to excel in everyday challenges.

Things like knowing the functions of money, setting financial goals and using savings wisely will encourage a healthy relationship between children and the money they earn.

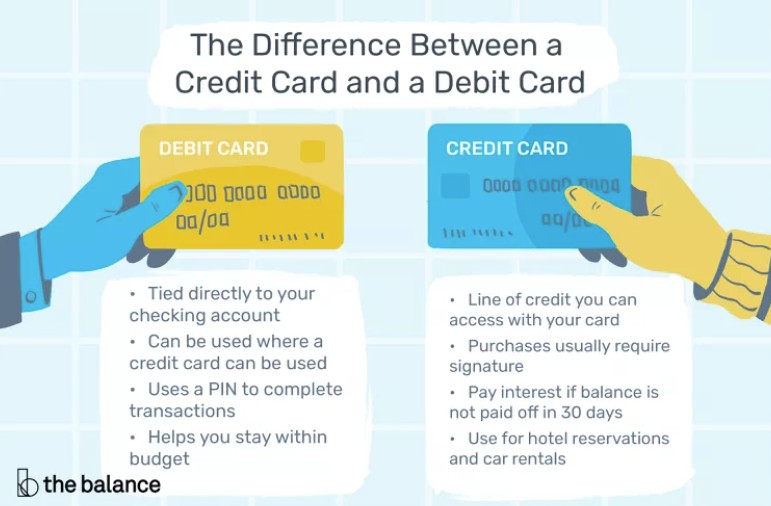

Money Info: Credit Card vs Debit Card

It is important to distinguish between the two types of card and to explain to the little ones the idea of operation behind each of them. The credit card is the card that contains borrowed money, and the debit card is the card where we find our personal money, the money we earn. Cash payment, credit card payment and debit card payment are the most popular ways to pay for goods and services. Knowing how to use all three wisely can transform a child's life, and in the future, when they can make informed decisions about how they spend their money and the level of debt they want to have.

Photo source:The Balance / Theresa Chiechi. PHOTO: THE BALANCE / THERESA CHIECHI

Photo source:The Balance / Theresa Chiechi. PHOTO: THE BALANCE / THERESA CHIECHI

Money Info for Kids: How to help kids save money?

Saving is one of the most important skills we can train from an early age. When we have a clearer picture of our long-term finances and what we want, savings goals can be easily set. Saving money can be for a future object or investment, for a need, for a want, or for the unpredictable. There are lots of ways that saving money can have a positive impact on our lives. When kids want a new toy, book or electronic device, help them plan their savings goals and think ahead so they understand the value of money and the difference between need and desire.

*Article written by Veronica Dunga, KEN Academy trainer.